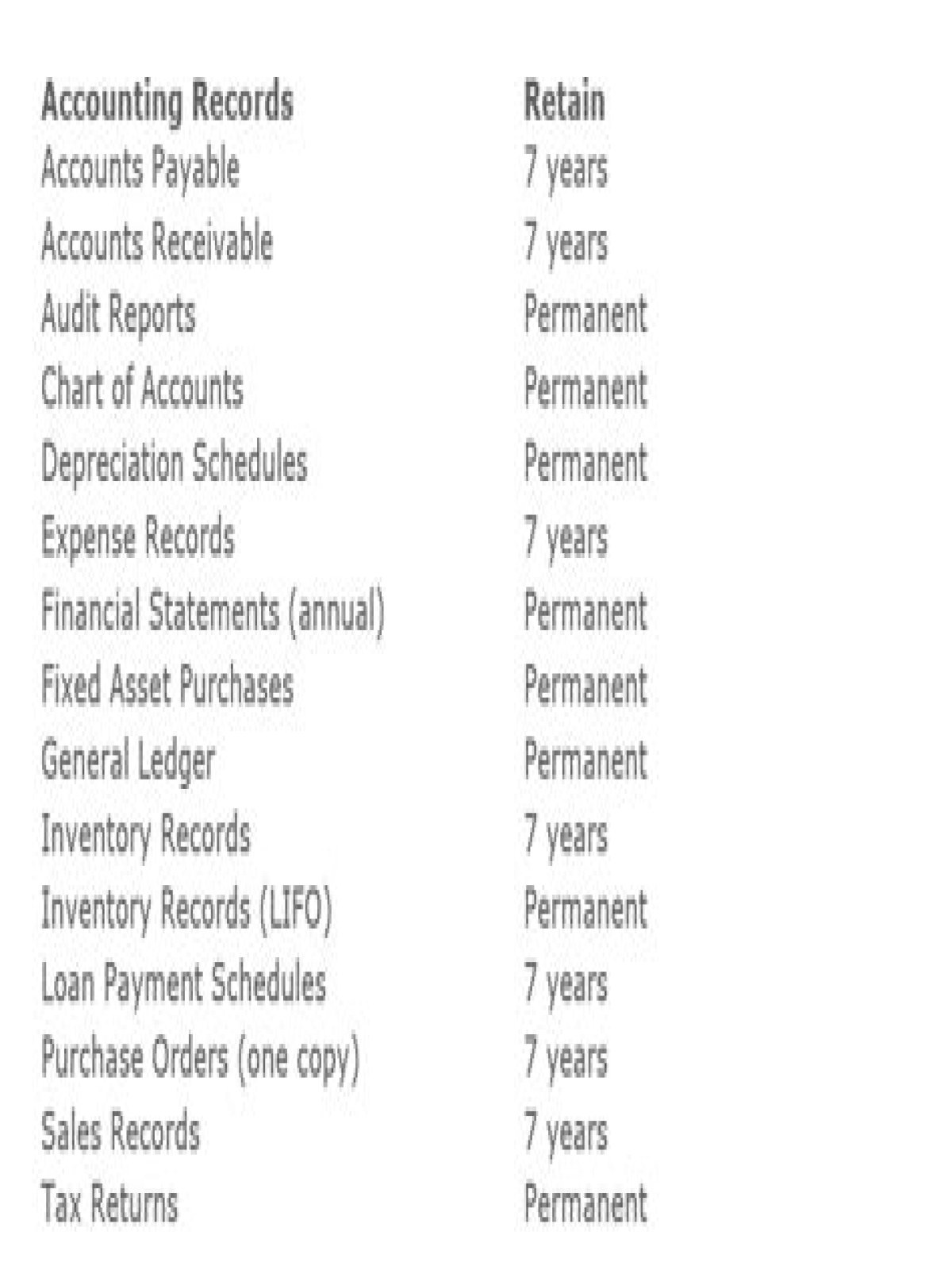

seven years The General Rule Most lawyers, accountants and bookkeeping services recommend keeping original documents for at least seven years. As a rule of thumb, seven years is sufficient time for defending tax audits, lawsuits and potential claims.

Do CPAs keep copies of tax returns?

The IRS mandates that tax preparers keep information for a minimum of three years from the date the tax return is filed. Although you’re not obligated to keep records any longer than three years, doing so can be helpful for your client if he’s subject to an IRS investigation down the road.

What is the IRS record retention policy?

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Can I return something with a photo of a receipt?

Many stores now keep a complete record of every sale in a database. Those stores don’t need an original receipt. They can simply look up the number from your photo of the receipt and validate it. Once you return the item, the receipt is marked in the database so that it cannot be used for a return again.

How many years do you keep income tax returns?

3 years Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

A tax preparer is expected to keep tax records for at least three years. According to Internal Revenue Service Bulletin 2012-11, the tax preparer must keep tax returns, along with supporting documentation for a minimum of three years and in some situations, it is recommended to keep them longer.

Can my accountant withhold records?

The accountant can withhold his own workings if he hasn’t been paid for them. If you have all your records from that period though your new accountant should be able to reconstruct the VAT returns if that is all you need.

How long should you keep your tax returns?

How Long To Keep Tax Returns In most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the due date of your tax return, whichever is later. What Tax Records Should I Keep? You should keep every tax return and supporting forms.

Is there a statute of limitations on keeping a tax return?

Keeping tax returns for the three-year time period is tied to the IRS statute of limitations. Under the statute, if you do not file a claim for a refund that you are entitled to, you generally have the later of three years from the date you filed the original return or two years from the date you paid the tax, to file the claim.

How long should a CPA record be retained?

How long records should be retained depends on a variety of factors including, but not limited to: Type of service: The firm’s areas of practice, and the professional standards that govern them, should be considered to identify any applicable record – retention requirements.

Do you have to keep a copy of your tax return?

Along with the client’s main tax return, you must keep a copy of any documentation that your client provides you about his tax return. Be sure to retain: Receipts, bank statements, general ledgers or other financial information furnished by the client. The IRS allows you to keep documentation in either physical or electronic format.