Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits.

Is disability tax free income?

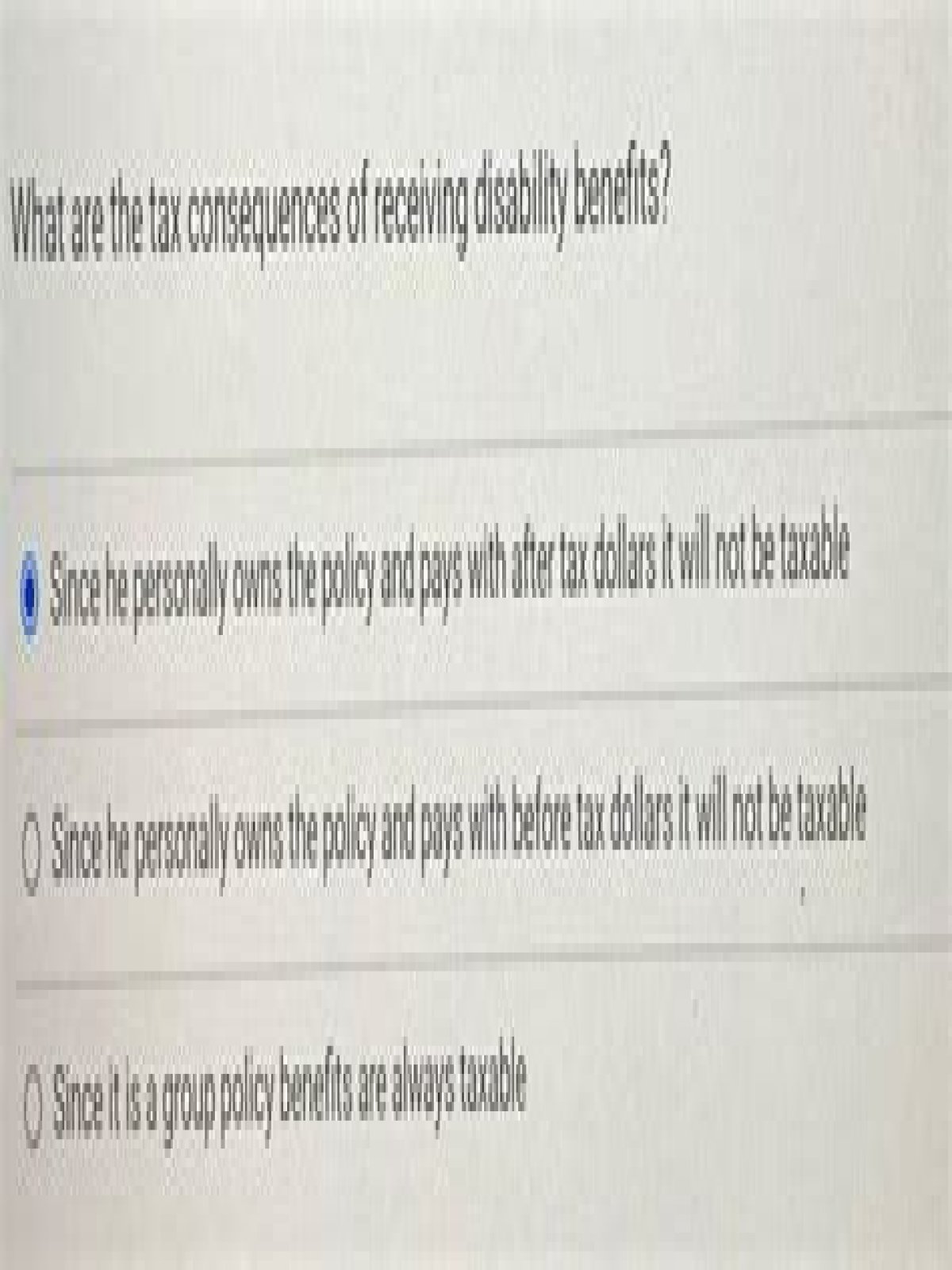

In the case of disability pay, whether it is taxed or not usually depends on who paid for the disability insurance coverage. In that case, the payments you later receive on disability are tax-free.

Do you have to claim disability payments on your taxes?

If you and your employer share the cost of a disability plan, you are only liable for taxes on the amount received due to payments made by your employer. So, if you pay the entire cost of a sickness or injury plan with after-tax money, you do not need to report any payments you receive under the plan as income.

Do you have to file taxes on disability benefits?

If Social Security Disability benefits are your only source of income and you are single, you do not necessarily have to file taxes. If your income is more than $34,000, then you may have to pay taxes on up to 85 percent of your Social Security Disability benefits.

Do you pay income tax on disability benefits?

If an employer pays disability insurance premiums for an employee (and the employee is the beneficiary), the premiums are excluded from the employee’s income. However, the employee must pay income tax on any disability benefits received under the policy.

Are there any benefits that are tax free?

Group term life insurance. A company may provide up to $50,000 in group term life insurance to each employee tax free. If an employee is given more than $50,000 in coverage, the employee must pay tax on the excess amount. However, this tax is paid at very favorable rates. Disability insurance.

What kind of tax credits do you get for disability?

These include: 1 Social Security Disability Insurance 2 Supplemental Security Income (SSI) 3 Military disability pensions More …

Do you get the EITC if you get a disability?

If you’re unsure if you qualify for the EITC, use the EITC Qualification Assistant. If you get disability payments, your payments may qualify as earned income when you claim the Earned Income Tax Credit (EITC). Disability payments qualify as earned income depending on: