The cost basis of stock you received as a gift (“gifted stock”) is determined by the giver’s original cost basis and the fair market value (FMV) of the stock at the time you received the gift. If the FMV when you received the gift was more the original cost basis, use the original cost basis when you sell.

Do you pay capital gains on gifted stock?

The recipient of a gift does not pay tax on any gift valued at $11,000 or less, no matter if it is a boat, car, cash, or stock. This means you don’t owe taxes at the time of the gift of the stock. When the recipient sells the stock, however, it is a taxable event.

Do you pay tax on gifted shares?

You do not usually need to pay tax if you give shares as a gift to your husband, wife, civil partner or a charity. You also do not pay Capital Gains Tax when you dispose of: shares in employer Share Incentive Plans (SIPs) UK government gilts (including Premium Bonds)

Do I have to pay taxes on gifted stock?

No taxes are paid with the gift tax return unless the value of the stock is over the lifetime exemption equivalent ($5,120,000 for 2012). If you sell the stock, your gain will be based upon what your father paid for the stock and not what it was worth when he gave it to you.

Do you have to pay tax on gifted shares?

The good news is that there is no Capital Gains Tax on gifts of assets (including shares) you give to your spouse or civil partner. However, in the case of a gift of shares, the market value of the shares at the time of disposal is taken into account for capital gains tax and inheritance tax purposes.

How do you value a gift of stock?

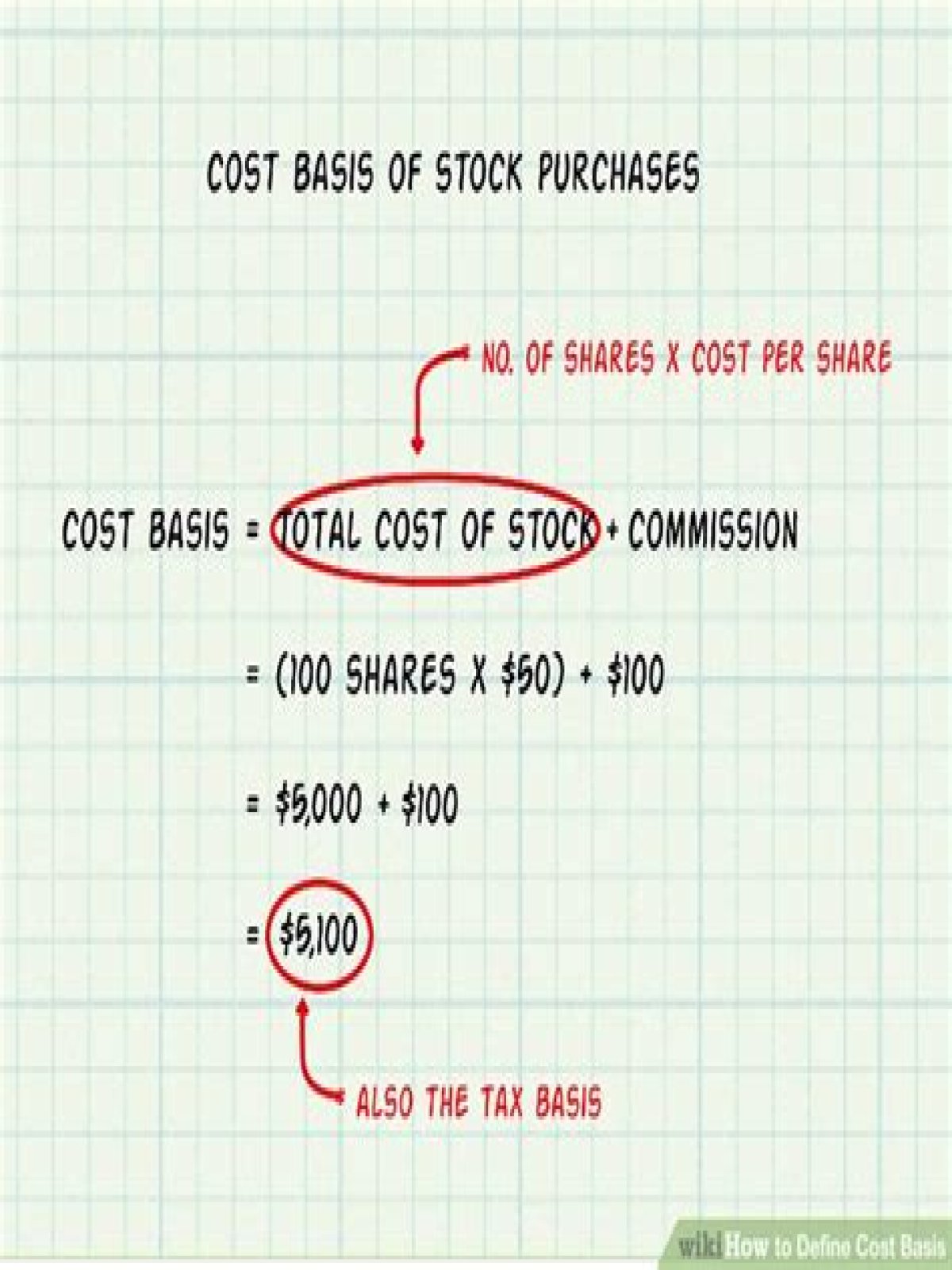

The simple answer to your question is no, the value of a gift of stock for gift tax liability is NOT the donor’s cost basis, but rather the fair market value of the stock at the time the gift is given. So let’s say you purchased 100 shares of XYZ stock at $50 a share.

How are shares with no par value accounted for?

The entry to record the issue of these no-par shares will be: Cash 85,000 Ordinary Shares 85,000 When shares without par value are sold, the proceeds should be credited to the Ordinary Shares account. Accounting for issuance of preference shares is basically the same as that of ordinary shares.

How much is XYZ stock worth as a gift?

So let’s say you purchased 100 shares of XYZ stock at $50 a share. Your cost basis is $5,000. Now the stock is $80 a share and you give it as a gift. The value of your gift for gift tax purposes is $8,000. In 2019, you can give up to $15,000 to an unlimited number of individuals each year without paying a gift tax or even reporting the gifts.

Who is known as the father of value investing?

Benjamin Graham (1894 – 1976) was an American economist and a professional investor and is considered the “father of value investing”. Graham developed a track record of earning solid returns to the stock market for himself and his clients and for doing so without taking enormous risks.